Money magazine helps you manage your finances by cutting through the jargon to deliver clear and precise information to help you save money and make the most of your investments. Each issue, you'll enjoy credible, well-researched reports and expert commentary from some of Australia's most respected financial writers.

Dust off the cobwebs

Letter of the month

How will you spend your tax refund?

Money Australia

IN YOUR INTEREST • If we really could time the market we’d all be billionaires

CALENDAR OF EVENTS

How Australians could have saved $150m • Check the numbers before transferring money overseas

Hold your nerve on shares

Investors value ethics, too

NEWS BITES

TOUGH CUSTOMER: CHASING A BETTER DEAL FOR BATTLERS • Melbourne University Press, $34.99

How Aussies stay connected

APP OF THE MONTH • GIFTSTER COST: FREE OS: IOS 10.0 OR LATER, ANDROID 4.0.3 AND UP

TAX TIP • Compensation could be taxed

Girls just want to have funds

Home loan borrowers doubt ‘good’ deals

Mortgage remains a big burden

Housing market slow to respond

Conflict takes its toll

Glimpse of the future spurs the urge to save

Payouts are slow to grow

Star Entertainment (SGR) • The Intelligent Investor Graham Witcomb

Living and learning

Fact file

How to pay the mortgage and invest at the same time • Even with loan repayments, it’s still possible to invest to boost your wealth

It’s a strong start but borrowing even more could pay off • Jonathan is a wealth management partner at HLB Mann Judd in Sydney and has expertise in wealth accumulation strategies and personal tax planning.

Hold onto shares • Nathan has 20 years’ investment experience and is head of research and portfolio management at Intelligent Investor.

Count the costs • Caroline is a mortgage broker with Mortgage Choice in Fortitude Valley in Queensland as well as the author of Buy That House – How Kickass Women Make it Happen.

Q&A

NEED PAUL’S HELP?

SMART SPENDING

PAUL’S VERDICT

Should we buy a business or house?

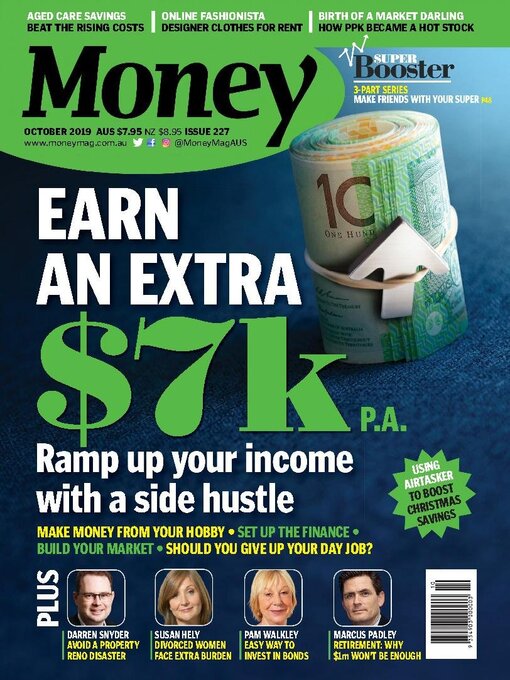

EARN AN EXTRA $ 7k P.A. Ramp up your income with a side hustle • Whether you need to top up your household budget or you’re saving for a big holiday, a part-time or casual job could be the answer. And for budding entrepreneurs it can be the pathway to an exciting new career or business. Here we explain how to make it happen, and our case studies share the secrets of their success.

State of the nation

In a more caring world • Costs are forecast to increase, so it pays to know your way around the numbers

Make friends with your fund • Digital technology means it’s easier than ever to know whether you’re on track with your retirement savings

Decode your annual statement • Your annual super statement has arrived. These are the things to check

Plan for the best • You can avoid any nasty family dramas if you carefully consider what should happen to your estate

When the support runs out • Divorced women in particular can struggle with their kids’ living costs

Make it easy for young savers • Convenience can be just as important as interest rates and penalties

The true horror of Halloween • The fun hides what we should really be worried about: the fear of saving

Three ways to celebrate World Savings Day

For the love of fashion • Join the fun by renting out your designer outfit for a special occasion

AT A GLANCE

Avoid another DIY disaster • Planning your reno properly will add value long term

FACT FILE

Hard work pays off in a...

Apr 01 2024

Apr 01 2024

Mar 01 2024

Mar 01 2024

Feb 01 2024

Feb 01 2024

December 2023/January 2024

December 2023/January 2024

Nov 01 2023

Nov 01 2023

Oct 01 2023

Oct 01 2023

Sep 01 2023

Sep 01 2023

Aug 01 2023

Aug 01 2023

Jul 01 2023

Jul 01 2023

Jun 01 2023

Jun 01 2023

May 01 2023

May 01 2023

Apr 01 2023

Apr 01 2023

Mar 01 2023

Mar 01 2023

Feb 01 2023

Feb 01 2023

Dec 01 2022

Dec 01 2022

Nov 01 2022

Nov 01 2022

Oct 01 2022

Oct 01 2022

Sep 01 2022

Sep 01 2022

Aug 01 2022

Aug 01 2022

Jul 01 2022

Jul 01 2022

Jun 01 2022

Jun 01 2022

May 01 2022

May 01 2022

Apr 01 2022

Apr 01 2022

Mar 01 2022

Mar 01 2022